The post liquidity era – from buoyancy to uncertainty

This co-authored article is an attempt to summarize many vivid discussions with my debating partner and friend Etienne de Marsac – head of proprietary investments & senior Fixed Income PM at European Investment Bank – about the ongoing transition to a new market regime characterized by uncertainty and its impact on asset prices and relevant investment strategies.

David Deddouche @DDeddouche Etienne de Marsac @etiennedemarsac

Without doubt, 2018 will prove to be a transitional year. After almost a decade of outsized liquidity cushion, markets have witnessed in disbelief a succession of sharp market adjustments: the burst of the Bitcoin, a sudden weird drop in equities, a widening of the Libor-OIS spread, the selloff in leveraged Loans, and finally Emerging markets… a sequence of events reviving some forgotten memories of the 2007 crisis.

Are these Sharp moves simply temporary knee jerk moves related to the end of quantitative policies, or a more worrying harbinger of a switch to a new equilibrium where uncertainty is the “new” – “new normal””? Given the context, there must be a meaning to these sharp moves. If so, we need to worry about a reversal in risk premiums, as growth tail risk scenarios become ever fatter. And in investment terms, within such a context characterized by unforecastable breaks and disruptions, “long only” strategies or pure quantitative methods become insufficient for investors.

Volatile market moves have become increasingly frequents this year. This is occurring as the unwinding of quantitative monetary policies finally started and gradually awakened investors’ uncertainty. In hindsight, 2018 will mark the true end of this amazing QE area that started intellectually 16 years ago, with the prophetic helicopter speech by Ben Bernanke in 2002. This experimental idea of massive purchases of bonds by central banks has been extremely successful but has had the major unexpected side effect of massively suppressing volatility (as ECB’s B. Coeuré recently reminded). With the increased predictability of monetary policies, all risk premiums (term premium, inflation premium…) have tightened durably, and risk assets have been supported. This lengthy period, exceptional in all aspects, ends this year, as the Fed’s balance sheet contracted by $100bn in Q1. Probably even more meaningful, forward guidance which was the ultimate certainty provider has just officially ended at the June FOMC. This 16-year period is now over. Doubts, policy debates, data shocks should now be expected to engender more uncertainty – as it used to be the case – with impacts on all financial asset classes.

Beyond this normalization, the next major source of uncertainty is shaping up amongst Central Banks as we approach R*.When QE had to be implemented, the intellectual challenges to this new policy were quickly removed : there was emergency, and free liquidity was the only obvious solution. Since these policies have to normalize, the beautiful consensus is fading fast. For a couple of months now, some quite striking and rare public disagreements have occurred between central banks on central concepts around potential growth, output gap, and R*. Successively the BOC, the ECB, and the Fed have not only questioned the hysteresis effects [1] (slowing potential growth during an economic crisis, developed by O. Blanchard), but also come up with contrasted views, if not opposing. The BOC [2] has shown a refreshing though childlike faith in the new technologies ability to drive up productivity and potential growth. The ECB [3] on the contrary, suggested that potential growth had probably merely fallen during the financial crisis, against all previous estimates. And finally, the Fed [4], maintained its view that the long-term potential growth had unfortunately not moved up an inch after its drop. These diverging views have interestingly allowed each central bank to justify some very different reaction functions. The BOC finds grounds to keep its rates low despite obvious inflationary pressures thanks to this ever-output gap “eternity” (as the potential growth rises, while growth rises, growth remains non-inflationary). The ECB on the contrary, thinks it has to start its exit sooner given that the accommodation has been much larger than justified. And finally, the Fed can maintain its steady pace despite record low unemployment. It is very likely that this growing discordance is going to feed increasing doubts about central banks reaction functions. Furthermore, the departure at the Fed of the all-star team of intellectual reference economists – Fischer, Bernanke, Yellen and Dudley – is going to make the debate even more difficult to grasp.

In parallel to these monetary matters, the other major factor feeding uncertainty is the potential extreme economic and institutional consequence of Trump’s policies. Within OPEP, NATO, or WTO, the Trump’s administration upsets the status quo. In the end, whether it proves to be merely a frequent use of aggressive negotiation tactics, or a major long-term strategic shift aiming at countering China, it is now clear that the disruptive impact is going to be real. The dollar for instance, one of the two pillars of the global financial system should be impacted in at least two of its core functions: its use as an intermediary in exchanges, and as a store of value. Indeed, the demand for dollars is impacted already by the systematic use of financial sanctions. The exorbitant privilege in a sense is moving from the economic arena to the geopolitical one, pushing the world towards alternatives to the dollar. More worrying in terms of growth scenarios, if the aim of the trade war is to slow the ruthless Chinese IT acquisition strategy, whose pace threatens the US military and its geopolitical hegemony, then the tensions have a long way to go. This could prove to be the end of Bretton Woods institutions and of the globalization move started 70 years ago – two key buildings of global stability. For sure, if the last decade’s consensus was defined by secular stagnation and QE infinity, they have been replaced by a universe of extremely diversified possible scenarios with much fatter extreme tails, such as the reversal of globalization.

In this context of policy uncertainty and fat tail macro-economic scenarios, what are the consequences for financial assets and investment methods? Rising uncertainties will necessarily translate into financial assets. Some degree of reversal in ever tighter risk premiums seems unavoidable under all forms: term premium, credit spread, yield curve. What would be the sequence? Most likely, the first to be affected should be the 10Y USD yield – the other key anchor of the global financial system (with the dollar). Its observable components (real yield reflecting growth, and breakeven inflation reflecting inflation expectations) have already risen significantly in the last semester. Yet, the term premium remains close to its lows (graph 1, around -50bp today against +150bp before the crisis). The decline in the premium was explained by many factors, such as the demand for riskless assets, budget deficits, financial volatility. But, the IMF in its latest global financial stability report has warned that it will rise significantly should investors become more uncertain about growth, inflation and monetary policies. That’s precisely what is shaping up. In other words, it is not just inflation that is going to determine whether US 10Y yields break the 3% threshold, it is more likely to be the term premium’s normalization as we see a reversal in the certainty about economic scenarios and readability of monetary policies that has characterized the previous decade.

After years of airiness engendered by QE, uncertainty is now about to trigger a reversal in the compression of risk premiums. Bernanke, specialist of the 1929 great depression, proposed QE policies to avoid the catastrophic spiral of crisis, unemployment and austerity, that led to trade wars and rising populism. Isn’t it ironical and scary that despite the success of QE in economic terms, we are to some extent flirting with the same outcomes – trade wars and populism? Markets are not reflecting these fat tail scenarios. And this is happening precisely when a major debate about monetary policy is shaping up.

In such a context of rising uncertainty, the rise of Term premiums will spread to all assets. Subsequently, only active managers seeking absolute return, and relying at least partly on discretionary inputs and not exclusively on quantitative tools will be able of navigating the unforecastable breaks of unsteady equilibriums that accumulated over the QE area.

[1] Should We Reject the Natural Rate Hypothesis? Olivier Blanchard (PIIE) November 2017

https://piie.com/publications/working-papers/should-we-reject-natural-rate-hypothesis

[2] The (Mostly) Long and Short of Potential Output – Lawrence Schembri May 16, 2018

https://www.bankofcanada.ca/2018/05/mostly-long-short-potential-output/

[3] Scars that never were? Potential output and slack after the crisis- B Coeuré, Member of the Executive Board of the European Central Bank – 12 April 2018. https://www.ecb.europa.eu/press/key/date/2018/html/ecb.sp180412.en.html

[4] The Future Fortunes of R-star: Are They Really Rising? J WILLIAMS President Federal Reserve Bank of San Francisco – May 15, 2018 https://www.frbsf.org/economic-research/publications/economic-letter/2018/may/are-future-fortunes-of-r-star-really-rising/

A great Jackson Hole – Yellen epic split between hawkish ST (hikes coming) & dovish LT (lower R*) messages

The Brexit risk has delayed Central Banks’ communication on key topics. A better understanding of the Fed’s framework is now urgently needed, and we will have some important answers on Friday. There are at least 3 debates that should be dealt with – 1/ Will we have Fed hikes in H2 2016?, 2/ Where is the LT equilibrium (neutral) Fed Fund rate aka R*?, 3/ What’s left in policy making (higher inflation targets or explicitly going for an inflation overshoot / fiscal / income policies)? The reaction of different asset classes might be quite messy, as some are more sensitive to questions 1, 2 or 3…

The SF Fed’s president Williams had a communication malaise last week which reflects well the current Fed challenge. On Tuesday he had an extremely dovish (and fascinating) speech dealing with available macro policies in a low R* world, then on Thursday he made an hawkish speech declaring that rates could be hiked in coming months. The market was very confused, but indeed just like during the past 3 years, we are in a macro context where Fed’s communication is very challenging.

* But these debates had actually been heating up for quite a while. I discussed them briefly in June. Powell in particular had a really great introductory speech on these Supply Side issues and as I wrote in June given the size of the output gap, he already confirmed that the equilibrium interest rate (the peak in Fed Funds) would be much lower than before the crisis:

Lower potential growth would likely translate into lower estimates of the level of interest rates necessary to sustain stable prices and full employment. Estimates of the long-run “neutral” federal funds rate have declined about 100 basis points since the end of the crisis. The real yield on the 10-year Treasury is currently close to zero, compared with around 2 percent in the mid-2000s. Some of the decline in longer-term rates is explained by lower estimates of potential growth, and some by other factors such as very low term premiums.

To sum up so far, estimates of long-run potential growth of the U.S. economy have dropped from about 3 percent to about 2 percent in the wake of the crisis, with much of the decline a function of slower productivity growth. The decline in realized productivity growth seems to be driven both by low capital investment that is well explained by weak demand and by lower TFP growth. Expectations of lower productivity growth going forward are more a function of slower gains in TFP. Lower potential output growth would mean that interest rates will remain below their pre-crisis levels even after the output gap is fully closed and inflation returns to 2 percent.

At the same time he was noting in terms of consequences for monetary policy that this lower R* didn’t mean that rate hikes had to stop:

If incoming data continue to support those expectations, I would see it as appropriate to continue to gradually raise the federal funds rate. Depending on the incoming data and the evolving risks, another rate increase may be appropriate fairly soon. Several factors suggest that the pace of rate increases should be gradual, including the asymmetry of risks at the zero lower bound, downside risks from weak global demand and geopolitical events, a lower long-run neutral federal funds rate, and the apparently elevated sensitivity of financial conditions to monetary policy. Uncertainty about the location of supply-side constraints provides another reason for gradualism.

There are potential concerns with such a gradual approach. It is possible that monetary policy could push resource utilization too high, and that inflation would move temporarily above target. In an era of anchored inflation expectations, undershooting the natural rate of unemployment should result in only a small and temporary increase in the inflation rate.15 But running the economy above its potential growth rate for an extended period could involve significant risks even if inflation does not move meaningfully above target. A long period of very low interest rates could lead to excessive risk-taking and, over time, to unsustainably high asset prices and credit growth. Macroprudential and other supervisory policies are designed to reduce both the likelihood of such an outcome and the severity of the consequences if it does occur. But it is not certain that these tools would prove adequate in a financial system in which much intermediation takes place outside the regulated banking sector. Thus, developments along these lines could ultimately present a difficult set of tradeoffs for monetary policy.16

* Then on August 8, came the semiofficial confirmation with Bernanke’s piece. It is almost official (just waiting Yellen confirmation) R* is lower, and the rate hike cycle is going to longer but to a lower endpoint.

The two changes in participants’ views that have been most important in pushing the FOMC in a dovish direction are the downward revisions in the estimates of r* (the terminal funds rate) and u* (the natural unemployment rate). As mentioned, a lower value of r* implies that current policy is not as expansionary as thought. With a shorter distance to travel to get to a neutral level of the funds rate, rate hikes are seen as less urgent even by those participants inclined to be hawkish. Likewise, the decline in estimated u* implies that bringing inflation up to the Fed’s target may well take a longer period of policy ease than previously believed. The downward revisions in estimated u* likely have also encouraged FOMC participants who see scope for further sustainable improvement in labor market conditions.

[…]

The bottom line is that, broadly speaking, FOMC participants’ views of how the economy is likely to evolve have not changed much: They still see monetary policy as stimulative (the current policy rate is below r*), which should lead over time to output growing faster than potential, declining unemployment, and (as reduced economic slack puts upward pressure on wages and prices) a gradual return of inflation to the Committee’s 2 percent target. However, the revisions in FOMC participants’ estimates of key parameters suggest that they now see this process playing out over a longer timeframe than they previously thought. In particular, relative to earlier estimates, they see current policy as less accommodative, the labor market as less tight, and inflationary pressures as more limited. Moreover, there may be a greater possibility that running the economy a bit “hot” will lead to better productivity performance over time. The implications of these changes for policy are generally dovish, helping to explain the downward shifts in recent years in the Fed’s anticipated trajectory of rates.

* But of course, last week, Dudley, Stan Fischer and also Williams then were quick to say that a lower endpoint didn’t mean the end of hikes – as the markets were quick to price. And we saw a reaction particularly in Silver, and USD/EM as I had expected.

* So now Yellen is going to clarify all these points. R* is lower, so the endpoint of the hiking cycle will be lower and maybe delayed, but still hikes will be coming regularly if data stay on course of course. Also she will give her views about possible policy tools – allowing an inflation overshoot, moving the target, fiscal, helicopters… etc.

So what should we make of all that in terms of investment / trading?

* I would argue that of course there is a short term hawkish effect of the repricing of 2016 probabilities of hikes. They already moved from about 10% to 50% since the start of August. It could go a bit beyond if Yellen chooses to preannounce the hike, but not much as long as we are not really sure that a hike will come. My view is that there will be one hike in H2. The two trades I currently have (short Silver, and long USD/EM) always were short term in nature but are now probably closer to profit taking area.

* Now more interesting, what about the impact on other assets? Several smart investors believe that an equity crash is coming. Surely eventually, but I guess probably only after a last hurra. Why?

First everyone seems very pessimistic. Second, data are good.

Third and most important, the Genius of Fed Watching – Paul McCulley – last piece written more than 2 years ago, after a brilliant review of the last 20 years of monetary policy making, he already concluded that the neutral fed fund rate was too high and forecasted how it would be revised lower gradually. Importantly in terms of asset valuations, (given that assets are incorporating the neutral FF rate as a discounting factor), he concluded by stating that the final revision lower of this R* would probably be the last leg of the equity rally, and then would be a good time to reduce exposure.

“Which is why, for me, it is so befuddling that the Fed, and thus the markets, still clings – even if reluctantly – to one man’s estimate of an “equilibrium” real fed funds rate, made in 1993: John Taylor, who assumed it to be 2%, which, in his own words, was because it was “close to the assumed steady state growth rate of 2.2%.”

And that assumption became embedded in his ubiquitous Taylor Rule.

Simply translated, his Rule espoused that if inflation was at the Fed’s (then presumed, not explicit) 2% target, and if the economy was at its full employment potential (that is, the unemployment rate was at NAIRU, or the non-accelerating inflation rate of unemployment), then the “right” level for the Fed’s policy rate would be 4% – at-target 2% inflation plus his assumed 2% real rate “constant.”

Yes, that’s the origin of the 4% number that, to this day, the FOMC prints as its “longer-term blue dot” for where the fed funds rate “should be” (if the Fed were, theoretically, pegging the meter on both of its mandates).”

[…]

“The most basic, and intrinsically most powerful, framework for valuing stocks is, for me anyway, the Gordon Model, which incorporates the “risk-free” long-term real interest rate in discounting profits/dividends. Accordingly, if that rate is a function of the central bank’s “neutral” real policy rate plus a term premium, then it should be plainly clear that a structural reduction in the neutral real policy rate should have a profound upward impact on the “fair” valuation of both bonds and stocks.”

[…]

“I think they could get richer, especially for stocks, in the run-up to the day when the FOMC takes an “official” sharp whack to that 4% dot, which I expect will happen before the first policy rate hike. Ironically, that would probably be a good time to take tactical chips off the equity table, before the Taper Tantrum is reincarnated into the Hike Heebies.”

***

To sum up, there was a lot of delayed Fed communication on key topics because of the Brexit risks. It is probably going to be one of the most interesting Jackson Hole in years. But probably given the complexity of the different policy debates, and the different sensitivities of asset classes, there will be conflicting reactions – of course offering opportunities.

What will be most important to me will be how US equity markets react after a few days on the news that R* is officially lowered. If they resist, it would be an important signal from real money about their current investment choices, and DM equities (and EM) could then perform.

In the meantime I have started taking profits on my short Silver & long USD/EM risk exposure opened last week on this theme. (On the 2 main other themes Saudi and Japanese policy action ugently needed, I am still long Oil and long USD/SAR, and occasionally building long USD/JPY exposure).

USD/JPY at 130 and the Japanese HelicopterS – Bernanke’s MFFP & Blanchard’s Income policy

It is difficult to overstate the historical importance of the current policy proposals being made about Japan. If the right policy choices are made Japan could finally succeed in normalizing its economy. In the process USD/JPY and Nikkei could rally by 25%. If not, the extent of the accumulated distortions created by Abenomics will be such that a major crisis will probably become inevitable and would come much faster.

Milton Friedman once wrote that “When [a] crisis occurs, the actions that are taken depend on the ideas that are lying around. That I believe, is our basic function: to develop alternatives to existing policies, to keep them alive and available until the political impossible becomes politically inevitable.”

Japan’s economic situation for the last 20 years has indeed been a major laboratory of policy proposals, even if the authorities have failed to implement any of them successfully. In 1998, the Krugman’s papers on the Japanese liquidity trap were groundbreaking. In 2002, the fascinating Bernanke’s helicopter speech became a cornerstone of all monetary policies in the following 15 years.

And this year again, given the total failure of Abenomics, there were revolutionary policy proposals. From the inception of Abenomics I have criticized it, simply because what appeared key to get inflation up, were the structural reforms, and Abe showed absolutely no inclination to make any of them. Moreover the policy of JPY weakness without structural reforms could only be tolerated temporarily by other countries. It took a few years for the market to realize that, particularly with the expected Chinese reaction and we are now at that point in time, when policy makers have to do something.

So what are the proposals?

Income policy (Helicopter 2) – Blanchard / Posen paper

This policy’s starting point is the following: “Given the insufficient transmission of monetary expansion, for whatever reason, more direct measures are required to get inflation up in Japan. What is needed is a jump-start to a wage-price spiral of the sort feared from the 1970s”.

The graph below (MOF data) illustrates the big problem – the fact that Japanese Companies have made a lot of profits since Abenomics started but this hasn’t reached households, so the deflationary mindset remains. This is the big problem. Some good IMF papers show that this is due to a mix of weak corporate governance and duality of the labor market (I will discuss these points later on). In any case, the paper’s point is that the easiest and fastest way to bypass this problem is to make wage rises compulsory. This could be done quite easily by influencing public wages, institute wage indexation and several other measures involving the private sector and tripartite wage negociations.

As I have been arguing for several months on Twitter, this is undoubtedly the most important and fascinating proposal. There are signs that Abe has been thinking about it as he already tried to force moderate wage increases in some specific areas. Probably it was a trial for something bigger and more coordinated. If that was adopted, I am convinced that inflation expectations would increase fast, prices as well, putting an end to the deflationary spiral mindset. But to so with a lasting success would necessarily mean putting in place structural reforms and should be accompanied by a fiscal/monetary push. I hope this is what is being prepared in Japan.

MFFP – Money Financed Fiscal Policy (Helicopter 1) – Bernanke

This is a great but technical paper. The point is to show how in practice it would be possible to finance public spending through money rather than through debt. Bernanke focuses on the plumbing of monetary policy and on legal constraints, to stress that despite the constraints; it is absolutely feasible and would work well.

The money supply can’t be a direct target so how would it work in practice? CB are paying interest on reserves so how would that reduce the government’s financing cost? CB are not directly allowed to decide how the public money is spend so what institutional structure with the Treasury would make it legal? He proposes solutions to bypass or deal with all of these issues.

First, the central bank “rather than making an explicit promise about the money supply, could temporarily raise its target for inflation—equivalently, it could increase its target for the price level at each future date”.

Second, “when the MFFP is announced, the Fed also levies a new, permanent charge on banks—not based on reserves held, but on something else, like total liabilities. […] this device would make explicit and immediate the cheaper financing of the fiscal program associated with money creation”.

Finally, “A possible arrangement, set up in advance, might work as follows: Ask Congress to create, by statute, a special Treasury account at the Fed, and to give the Fed (specifically, the Federal Open Market Committee) the sole authority to “fill” the account, perhaps up to some prespecified limit. At almost all times, the account would be empty; the Fed would use its authority to add funds to the account only when the FOMC assessed that an MFFP of specified size was needed to achieve the Fed’s employment and inflation goals. Should the Fed act, under this proposal, the next step would be for the Congress and the Administration—through the usual, but possibly expedited, legislative process—to determine how to spend the funds”.

Simply brilliant. But his paper lacks (voluntarily of course – he is not discussing Japan’s case specifically), the key areas of what to do in terms of fiscal spending, also he doesn’t delve into essential structural reforms.

IMF article 4 & WP – structural reforms

More recently came the most stunning of all these developments – an official endorsement by the IMF of the Income policy proposed by Blanchard with details of the needed structural reforms and Monetary/Fiscal coordinated support. (My tweet at the time clearly showed the excitement). This concluding statement of the upcoming article IV is actually building on several in depth working papers by the IMF that I will discuss later.

Here are key points:

They start with, the really revolutionary part on Income policies… clearly endorsing Blanchard’s proposals:

“Income policies combined with labor market reforms should move to the forefront. Monetary and fiscal policies in isolation cannot achieve the inflation target in the envisaged timeframe. Reinvigorating wage-price dynamics can generate sustained cost-push inflation, a powerful tool to first raise actual and then expected inflation. A deflationary mindset, the absence of a mechanism to coordinate wage and price increases (a role usually played by well-anchored inflation expectations), and a secular decline in the bargaining power of labor have led to base wage inflexibility. Meanwhile a rising share of non-regular workers with lower wages has lowered average wage growth. This highlights the need for bolder policies to directly target the wage bargaining process and reforms to reduce labor market duality:

Income policies: The government can introduce a “comply or explain” mechanism for profitable companies to ensure that they raise base wages by at least three percent (the inflation target plus average productivity growth) and back this up by stronger tax incentives or—as a last resort— penalties, given that the latter would be contractionary if they failed to trigger higher wages. In addition, the government can commit to raising all administratively controlled wages annually and ensure this is followed at the prefectural level. These measures can be supported by calling for supplementary wage rounds and conversion of bonuses to base pay.

Then they move to the KEY labor market reforms (more on that later):

Labor market reforms: Promoting “intermediate” contracts that balance job security and wage increases, including by clarifying the legal framework and providing subsidies for converting non-regulator workers to such contracts, would reduce labor market duality and reinforce income policies provided new hiring is done under these contracts. It would also stimulate productivity growth through greater incentives for skill formation. Eliminating disincentives to full-time or regular work due to the tax and social security system such as the spousal deduction and spouse allowance, as well as raising the availability of child-care facilities through deregulation remain critical.”

“More structural reforms especially in the labor market are the only viable option to significantly raise growth prospects. Without high-impact reforms, potential growth is projected to decline from about 0.5 percent in 2015 to close to zero by 2030, given the demographic overhang. In addition to measures to boost domestic labor supply of women and older workers, increased reliance on foreign labor should be considered.”

They clearly state that another fiscal policy (probably even if money financed) would be a waste of time and resource. That’s clearly THE risk scenario:

“Without ambitious income policies and the associated comprehensive reforms, an expansionary fiscal policy stance would have limited impact”.

They fall short of endorsing the MFFP proposed by Bernanke, but still insist on coordination:

“Income policies and structural reforms should be reinforced by coordinated demand support. To facilitate the pass-through of higher wages to prices and the implementation of labor market reforms, it is imperative that monetary and fiscal policy give a balanced and sustained growth impulse in the near term, warranting a modest near-term fiscal expansion, calibrated on the need to accelerate the closing of the output gap. Fiscal stimulus should be coordinated with further monetary easing, where all policy tools should remain on the table.”

This analysis is based on several interesting working papers published by the IMF (not the views of the IMF) with in-depth analysis of the Japanese specificities; amongst them the problems poised by the labor market duality, and the corporate governance.

Some selected points from IMF – Wage-Price Dynamics and Structural Reforms in Japan:

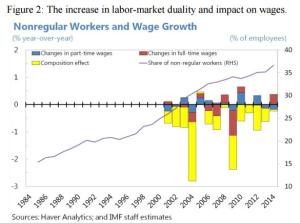

“The largest factor that has contributed to paltry wage growth, as can be seen in figure 2 [below], has been a composition effect: the share of workers who hold lower-paying non-regular positions almost doubled since 1991 to 37 percent of the workforce in 2014”.

“when the nominal interest rate is set against the zero lower bound, a labor-market reform that strengthens workers’ bargaining power moves the price level back towards the target but reduces employment. The stronger bargaining position of workers starts wage-price dynamics that reflate the economy”.

“Japan’s product market is characterized by a lack of firm dynamism as illustrated, for example, by the large share of cash holdings on corporate balance sheets [see graph below]. This too matters for price dynamics as firms have been reluctant to raise wages, investment, or dividend payments. I interpret this fact as an agency problem and therefore introduce a corporate-governance friction in the product market of the model: firm managers do not strictly maximize profits but engage in empire-building behavior putting some weight on the size of their firms when setting prices.”

“A simultaneous reform of corporate governance, which improves the incentive alignment of managers and shareholders, makes the effect of a given labor-market reform stronger in terms of reflating the economy. Corporate governance, by giving firms an incentive to react to changing costs, acts as the transmission belt that makes the developments in the labor market spill over to the product market.”

Graph from IMF – The Financial Wealth of Corporations : A First Look at Sectoral Balance Sheet Data. “The NFC sector’s NFW to GDP ratio has improved recently, particularly reflecting an accumulation of corporate cash and valuation gains on financial assets. Developments in individual countries differ significantly with some of the countries making progress in strengthening balance sheets and others facing continued pressures for debt reduction. Japan’s experience highlights the possibility that strengthening balance sheets could continue even after debt levels are reduced.”

All these points in my opinion, clearly suggest that the IMF views the behavior of Corporate Japan, its cash hoarding tendency, and the resulting lack of wage increases as one of the key constraints to monetary transmition, and that instead of waiting another decade to see a change of behavior through a process of structural reforms, and given the urgency, suggest that taking the short cut of compulsory wage increases would be the best and very efficient solution. I fully agree.

What’s likely to be implemented?

So we are at a time when some renowned policy makers and institutions are coming with new policy solutions for Japan, and when the authorities need to do something, and have the power to do so.

On the encouraging signs, as already discussed above, Abe has already ventured into wage control measures, so it could definitely be a trial for something bigger. More recently the Bernanke visit to Honda and Kuroda clearly suggest that MFFP is being considered. And it would be very logical given the fiscal constraints in Japan. On Structural reforms, a few measures on women participation and changes to corporate governance have been implemented. That was surely insufficient. On the key labor reform nothing occurred yet, but given the recent elections, and the sensitivity of this issue everywhere in the world, it only makes sense for Abe to have waited until now. So things could change in a global package of policy measures.

Also, the recent NIRP fiasco and the mess in Tax announcement, now push Japanese policy makers to be very cautious particularly when they are the first to try experimental policies. That suggests that they could take their time and announce all policies at once.

On the worrying signs, the recent fiscal policy package announcement even if very vague at this stage seemed to suggest that it would mostly focus on public infrastructure works. That would be really the worst scenario, more of the same, with wasted public money and policy tools on needless public infrastructure (bridges to nowhere).

Conclusion

Some huge policy announcements could come up soon in Japan. At least I hope so.

Adopting MFFP would of course push the USD/JPY and Nikkei higher, but would be a good / lasting (and tolerated by China and the US) policy only if that is accompanied by structural reforms. Otherwise that could be even more destabilizing in the MT for Japan.

More important to me are the structural reforms and Income policies. The monetary transmission mechanism is broken – probably at the firm / wage level and most likely because of the entrenched deflationary mindset – and consequently compulsory wage increases would surely trigger the spiral between wages and prices. Labor reforms are also key in this process.

I expected the announcements to start before the elections and started buying the USD/JPY in the week before (see twitter) – too early. It clearly has started right after the elections. And Bernanke’s visit right after the elections, and after the Brexit’s volatility window has closed, can’t of course be a coincidence. Hopefully we will have other encouraging signs before the BOJ meeting at the end of July, and also in the following weeks until September.

I am long USD/JPY and Nikkei. And if the news came out that Blanchard was to meet Abe I would get much bigger.

What the Fed doesn’t know (just like everyone else)

Since the weak NFP last month, the dispersion of possible eco scenarios considered by the Fed has risen significantly. Yellen will probably stay elusive today, given the few data available, and the Brexit risk. At best she could develop and explain each scenario. It is only at Jackson Hole in August that she is likely to give policy direction.

In her latest speech, Yellen was extremely clear, contrary to what so many investors say. She asks three questions that are precisely covering the possible interpretations of the weak NFP:

New questions about the economic outlook have been raised by the recent labor market data. Is the markedly reduced pace of hiring in April and May a harbinger of a persistent slowdown in the broader economy? Or will monthly payroll gains move up toward the solid pace they maintained earlier this year and in 2015? Does the latest reading on the unemployment rate indicate that we are essentially back to full employment, or does relatively subdued wage growth signal that more slack remains? My colleagues and I will be wrestling with these and other related questions going forward.

What are these scenarios?

1/ the weak NFP means that the economy is slowing. That is what the 2Y and 10Y bonds & Gold, have priced in the few days following the data. As I wrote immediately after the NFP on Tweeter, it is more complicated than that because it could also indicate some labor tightness issues.

2/ the weak NFP is an anomaly, and it will be back to rend shortly. There is of course the Verizon strike impact – about 40K workers. Plus the series has always been volatile.

3/ finally, her question is not so clear here, but the idea she develops is whether the weak NFP indicates that the output gap is closing, which means that the economy will now create less jobs and wages will start rising. That will be typically visible through signs of skills-mismatch. That’s of course to be expected at some stage given the normalization of US employment (see graph 1 – full time employment).

So the next interesting question is whether we already have data possibly discriminating between the three scenarios above? I think we do, but it’s surely premature for a conclusion and even more for Yellen to make a decision and communicate it.

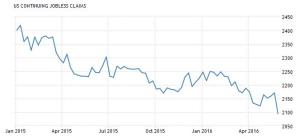

1/ First, high frequency data show that there hasn’t been layoffs, so the labor market still seems strong, even though there are less job creations. Probably if we were in a scenario of upcoming recession / growth slowdown we would see layoffs and rising claims. So the scenario 1/ doesn’t seem consistent with data so far.

2/ Second point, not key, but still worth mentioning, there are reasons to explain a distortion. As discussed, there is the Verizon strike (well known factor and now over). But also there were indications that there was an unusual and unexplained divergence in the Michigan consumer confidence survey between the actual and expected components. “The [record] strength recorded in early June was in personal finances, and the weaknesses were in expectations for continued growth in the national economy.” One possible explanation is the start of the US presidential campaign particularly polarizing and aggressive this time. These campaigns are often artificially creating angst about future growth.

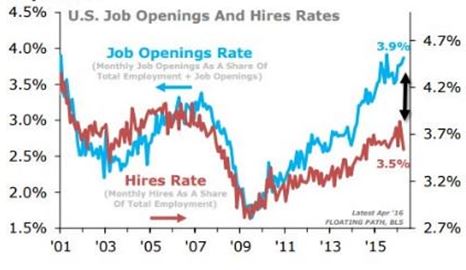

3/ Third point, and the most important, there are clear early signs of labor market supply problems. As I immediately wrote following the Jolts report it is really weird to have Job openings at a record high, and a sharp fall in hirings. Of course maybe Openings are going to turn down soon, but if it is not the case it would clearly indicate that businesses want to hire but can’t find qualified workers, which means that wages are soon going to rise faster.

With that there are many anecdotal indications of difficulties to hire. For instance in the Small Business confidence survey (NFIB): “Owners are still reporting that they cannot find qualified workers and cite it as their fourth “Single Most Important Business Problem.” “48 percent reported few or no qualified applicants for the positions they were trying to fill. Hiring activity increased substantially, but apparently the “failure rate” also rose as more owners found it hard to identify qualified applicants”

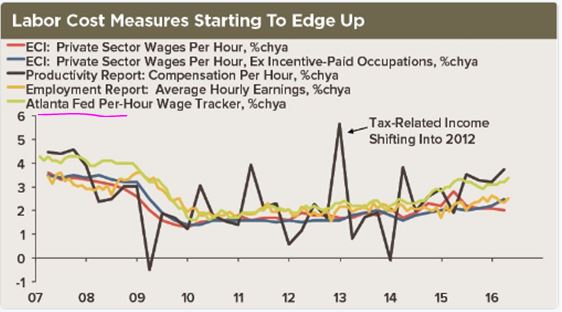

Also, there are clear signs of rising wages. The Atlanta Fed wage tracker for instance (immune from composition effects) clearly confirms it.

4/ Fourth point, there is one scenario not covered by Yellen, that I find quite interesting, the possible distortive effects of regulatory changes, particularly here the impact of the introduction / raise of minimal wages. That’s at least the view developed by some observers. And I must say I am surprised not to have seen much analysis about the impact of the introduction of these minimal wage regulations on labor / wage data.

Conclusions:

These are very important issues that the Fed could start discussing today. As Powell mentioned in his excellent speech on the labor market – previously discussed in this blog – “The implications for monetary policy of these supply-side issues have been limited, but they begin to matter more as we near full employment.”

Clearly, it is too early to say where the economy is going, so Yellen would stay very cautious and consider all cases. For instance some alternative measures of vacancies are giving a contradictory signal with the HWOL (help wanted online) index down lately (see below).

All in all, it is likely only at Jackson Hole on August 26 that Yellen should start having enough data to confidently give her assessment on whether the rate hike cycle continues as planned but to a lower long term Fed Fund equilibrium level (now at 3%), or whether there is indeed an economic slowdown.

In the meantime, while waiting for her official message, many in the market who have been increasingly confused by Fed communication and data directions, will probably continue to generate large swings ups and downs in US yields (and Gold), as this situation’s complexity is creating confusion. That is at least if there is no Brexit this week.

Global View – US data & Fed, OPEC, Brexit, EMU breakup & France’s desocialization

With Opec, FOMC, BOJ and Brexit- June is a month where selectivity and risk control should be even more stringent than usual. I won’t have pre-conceived conclusion and stay very flexible on the outcome of all of these risk events.

One thing that surprised me last week was the apparent positive correlation between US equities and rising expectations of Fed rate hikes. Apparently, the story was that banks were going to be supported by higher rates, which is true of course but still it is surprising that just the banking sector managed to trigger such a sharp equity rebound. There were of course possibly other factors responsible for the upmove (oil, Brexit odds… I am not sure). In any case if this correlation was to stay, it would be a noticeable change and a vote of confidence from investors.

Fed & US data

Of course given Yellen’s May 27 speech, what is really key for June is how US data this week will be. So far, the Chicago PMI and more importantly the Conference Board Consumer confidence have sharply disappointed. If that goes on in coming days, the odds of having a hike in June will drop in favor of July. Then, as we are on major supports on many assets (EUR/USD at 1.11, Tnote at 129.50, USD/ZAR at 16.00), we could see a larger rebound / conso before an eventual break later. I took profits on my short Gold, and established a tentative long EUR/USD for a very small size.

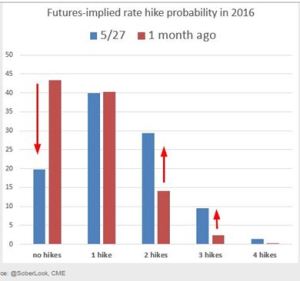

But beyond the debate on June / July hikes, I think what is really important, is that as recently as a month ago the market expected close to no hikes at all for the year, and now it appears that we are at the start of a series. (See chart from Soberlook).

If confirmed, this issue – the start of a cycle of hikes – is potentially a major change for all assets globally, so one should be ready for unexpected market moves. That’s going to be my structural bias over the coming months, I guess mostly through EM FX (long USD/ZAR) and short Gold – but again after a rebound ( have no more exposure at the moment). To be more precise what will be really key will be to gauge the length of the cycle (will there be 3 hikes this year, and 3 next year? Or just one per semester). To judge that, the key policy debates now are about the shape of the Philips Curve (where the Fed should aim to stabilize the Unemployment Rate and by how much will wages then continue to rise?), and the size of the Output Gap (Dudley & Yellen VS Fischer). On that matter, Powell gave a very instructive speech recently, and already confirmed that the equilibrium interest rate (the peak in Fed Funds) would be much lower than before the crisis. Now the whole question is the pace. We will surely know more about these issues in the coming two weeks, and investors could reprice their current pre-conceived ideas.

OPEC is meeting – another source of uncertainty

I already discussed this issue in my latest global view. Oil could peak if either: 1/ The true nature of a new Saudi oil strategy becomes clearer – why did they fire Al-Naimi? And why did they refused the Doha agreement if not to be able to increase their production (as they have announced for a while) and also to avoid a too sharp rise in prices. In that respect the foreign affairs paper discussing the rationale behind a possible strategy shift is very instructive. Also, 2/ will the current prices be sufficient (thanks to massive longer term hedging programs) to restart high cost production? (See graphs below from GS & Capital Economics). I am tempted to establish a short Oil (and actually already tried several times last week), to play a larger consolidation, given the amazing crowd in the long Oil trade.

Brexit, France and EMU Break-up odds – Renationalization and Desocialization

Odds of a Brexit according to a poll published yesterday are increasing sharply. Of course it would affect strongly UK assets and UK growth. But to me what really matters from a systemic point of view is that it would strongly increases the odds of an EMU break-up. Joschka Fischer – ex german Foreign Minister had an interesting write-up where he explained all the consequences that it could have: “A massive crisis of trust vis-à-vis Europe and its institutions has developed in most EU member states, fueling a revival of nationalist political parties and ideas and a slackening of European solidarity. The re-nationalization of Europe is accelerating, making this crisis the most dangerous of all, as it threatens disintegration from within. […] The euro might not survive. Despite signs of a moderate economic recovery in the eurozone, the gap between Germany and most other eurozone countries is widening and deepening. There is no longer any talk of convergence in the monetary union, and there hasn’t been for a long time. […] Europe’s leaders know that the euro is still anything but crisis-proof, despite technical improvements achieved during the previous crisis. Unless a renewed grand compromise is reached between Germany and other eurozone countries, it never will be. In practice, this would mean reforming the eurozone on the basis of deeper political integration – obviously no mean feat.” I couldn’t agree more. Importantly that systemic aspect of the Brexit is something that will not be instantaneous. There is a sequence where this “policy precedent” created by the first Exit of a large EU country, will potentially “spread” into public opinions and political proposals. Then what would be fatal would be decisions to ask for “special treatments” by Italy, Germany or France or anyone else! So that won’t happen overnight. That would probably gradually appear through the widening of core sovereign spreads such as France/Germany or Italy/Germany.

And that brings me to France, which is at an historic moment that will be central for Europe. Will it be able to reform its welfare state or not? Milton Friedman in the 2002 preface of his “Capitalism and Freedom” explains that “In country after country, the initial postwar decades witnessed exploding socialism. […] In all these countries the pressure today is toward giving markets a greater role and government a smaller one. […] Future desocialization will reflect the mature effects of the change in opinion”. As I have discussed in previous posts, Germany managed to go through this difficult process with Gerhart Schroeder with the Hartz IV laws more than 15 years ago. Spain and Italy have started the process a few years ago, during the EMU crisis. The big European question is whether France is ready for it, because so far nothing has changed. Previously (the 1982 preface) Friedman wrote “only a crisis – actual or perceived – produces real change”, and as a French observer, I don’t have at all the feeling that this sense of crisis has occurred yet (the El-Khomry law is largely unpopular). Let’s see what Valls manages to do, I hope he will succeed, but fear he will back track (the just announced massive rise in public wages and pensions in the education sector is already a very high cost).

All in all, for June, so far I have almost no risk exposure given the high degree of uncertainty (only SAR depeg + small EUR/USD long). I am tempted to short Oil. I expect a rebound in Gold before a break down (1200) once / if the start of a lengthy Fed rate hike cycle is confirmed. I would then also be inclined to buy USD/ZAR.

Why Saudi Arabia should depeg SAR and could shift its Oil strategy

A 10% to 20% devaluation of SAR vs USD, and probably a switch to a crawling peg to an FX basket would make sense.

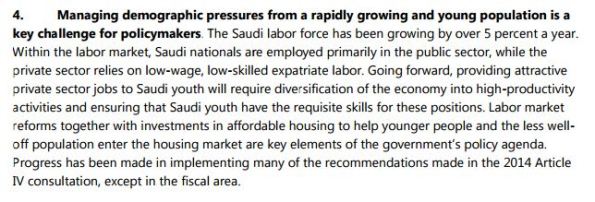

How the second shift in 2 years in Saudi’s Oil strategy (symbolized by the about-face at the Doha April 2016 meeting, and Al-Naimi’s departure) and some aggressive changes in the labor laws, made me completely change my view on the necessity of a SAR depeg. One of the key problem is demographic!

In January 2016, when Oil was at its lows I wrote in an FT comment (see full text at bottom) why a SAR depeg was foolish, unnecessary and highly unlikely (and why oil had just bottomed). I expected at the time a major rebound in Oil prices driven by a likely agreement between Opec and Russia, as had been suggested by Saudi Arabia (SA) since November 2015 (see my tweets in nov15 and jan16). The rational was that the Saudis had triggered a sharp Oil price correction since H2-14 to hurt the high cost producers, but once that was done successfully they wanted prices back to their fiscal breakeven which is about 90$.

The reason why they needed those elevated levels of prices is mostly political. The fear of the consequences of the Arab spring (Mubarak’s downfall and total absence of US support), and the policy the Saudis had adopted since then of huge public spending to quell any social discontent.

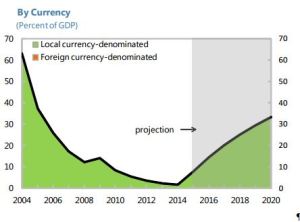

Hence abandoning the peg which had been a cornerstone of stability in the country – primarily by allowing inflation to stay low and stable – didn’t make any sense in that perspective. Indeed with the upcoming rebound in Oil prices, the fiscal difficulties were surely temporary – a matter of one or two years. Also as I argued in my FT comment (which by the way is still the IMF official line) a devaluation wouldn’t bring any competitive gains as SA’s main exports are priced in USD from Oil and Oil derivatives (see graph below – from last article 4 ). Also importantly the country’s private sector was relying on an army of foreign workers attracted by petro-dollar wages. So all in all, ending the peg would mean that Saudi nationals would have to work much more in the private sector – a huge societal and growth model change (see graph IMF) – and surely not in line with the policy of fiscal profligacy.

Then came Prince Salman… may he succeed!

As a Frenchman, I have true intellectual difficulties with the very idea of Royalty. BUT, I must recognize that there are sometimes dynasties of true natural born leaders – able to foresee necessary changes, gather society’s forces around them, and drive changes. If Rahul Gandhi surely is not one of them, Prince Salman surely could be. He has the intelligence to understand the challenges, the courage to dream big, and takes the risk associated. Of course there is a high probability of failure. But not moving also is a big risk. And these risks poised by reforms are precisely why I think he has to depeg the SAR because it will strongly increase his odds of success.

How did I realize the depth of the policy change?

First I was long Oil during the April 2016 Doha OPEC meeting (just as I had been short Oil during the Nov14 Opec meeting), and I was literally AMAZED to see that over the week end, the Saudis had shifted their stance and refused the agreement they had been calling for for months. Moreover, this was followed by the departure of Al-Naimi this historic figure of Oil policy. Importantly Al-Naimi was the architect of the policy that consisted in triggering a temporary price collapse to get rid of high cost producers. And he wanted that to be temporary and a return to levels consistent with fiscal breakeven. So his departure clearly suggested that things were changing seriously.

Second, I was stunned by the very aggressive recent labor law changes for foreigners in SA, which clearly suggested that internally something huge in terms not just of growth model but of societal model was going on. Clearly, they seriously want nationals to replace foreigners in the private sector, so attracting foreign labor with wages in USD equivalent is not needed anymore.

So all these points may look like some anecdotal secondary issues, but to me they are the real indicators of policy shifts. (And there are others – like the recent publication of US Treasury holdings by SA). Indeed, the economic case for the depeg is a function of these Oil and Labor policies. In other words once the right growth model and right oil policy are chosen, the positive effects of a depeg become obvious – see the annex 1 on the recently published “Economic Diversification in Oil-Exporting Arab Countries” by the IMF.

Why do they need to change the growth model?

James baker recently said that “These things are semi-revolutionary ideas“, “There does need to be some fundamental change with the way things are done in Saudi Arabia.” “They’ve got this huge workforce that they can’t employ… and of course they’re running some substantial budget deficits now”. The statement from the frontpage of the last Article 4 (yes again), is very clear. One of their main problem is demographic. To stigmatize, until now the model of high oil prices was just fine to hire everyone in the public sector, but now they need to have some real jobs in the private sector.

And that’s precisely the plan announced by the Prince (see long interview in the economist), and in line with the Mc Kinsey big reform plan (which is btw very much in line with what the IMF had been advocating) – see the 150pg online report – which is pretty ambitious to say the least. (Probably they worked too much on unicorns’ biz plans lately). In particular the second graph here shows the central ambitions they have for the private sector! That’s a key point for the rational of the depeg – as explained in the following paragraph. The graph also shows the extent of the population rise, indeed with a 5% annual population growth, they surely have to change the growth model!

Of course, what is still unclear (and clearly not reflected in Oil prices), is what’s their new strategy for Oil prices is. There are many factors of influence here, and primarily the threat that Oil prices could fasten replacement technologies and the end of Oil age – see this formidable article in foreign affairs. Of course, there are also external issues, such as the influence and state of economic development of Iran, but these are well known issues.

But in any case – whatever the new Oil price strategy – for the new economic model to succeed, a depeg would hugely help.

So let’s go into economics issues now – why would they need to depeg?

Of course the most obvious and well known figure that reflects that pressure to depeg is the sharp drop in FX reserves from about 750bn USD in mid 2014 to to about 580bn lately. They are used both to protect the peg and as a substitute to falling fiscal ressources (falling oil prices). But this is just a symptom of the problems actually, so beyond this figure, why would a depeg help?

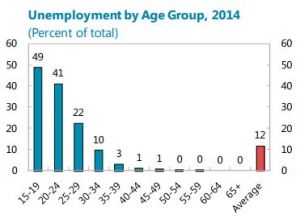

The IMF says it very clearly in his article 4 last year (the new one will be out shortly), REER has increased by 14%, while the Terms of Trades has collapsed – see graph and full text right below. So it is precisely the OPPOSITE of the counter cyclical adjustment that would be necessary. As a result all adjustment had to be done through fiscal means and through the highly flexible [poor foreign] labor market. And as I said above, the IMF concludes that a depeg wouldn’t bring any major benefits now because SA only exports Oil and Oil derivatives, so there is no competitiveness gain. Except that this isn’t true if there are major changes if the labor force composition. And at the same time, the Fund strongly encourages the govt to change the growth model, and lately showed it was extremely happy with Prince Salman reforms. Moreover the important paper in Annex 1 clearly shows the general framework for reform of Oil exporting countries, and it states that having a REER at fair value is a key pre-condition for economic diversification.

Here is the full IMF quote – pretty clear I think, given that the plan is to have a far less flexible labor market (nationals), and less reliance on foreign labor (that would revive FX competitiveness).

“33. Supported by the flexibility of the labor market, the exchange rate peg has provided monetary policy credibility and has helped deliver low inflation and inflation volatility.

Nevertheless, with the U.S. dollar appreciation, the REER has appreciated by nearly 14 percent over the past year while the terms of trade has fallen by over 30 percent in 2014–15. A more flexible exchange rate would have benefits for the stability of fiscal revenues in nominal riyal terms and enable a more independent interest rate policy, but given the structure of the economy (heavy reliance on oil exports and limited import competing industries which are anyway reliant on imported inputs, including labor) would have very limited benefits for competitiveness and could increase the volatility of inflation. Moving away from the peg would also remove a credible monetary anchor, and reduce certainty for trade and investment.

34. The authorities and staff agreed that the exchange rate peg remains appropriate for the Saudi economy. Nevertheless, staff suggested that the peg be reviewed periodically (in coordination with other GCC economies) to ensure it remains appropriate given the evolving structure of the Saudi economy due to ongoing labor market reforms and efforts to increase diversification. Meanwhile, reforms that would support a move to a more flexible regime, if this became appropriate in the future, would be desirable in their own right and could proceed (including strengthening liquidity management, improving monetary transmission by developing money and debt markets, and improving data on foreign currency exposures of corporates).”

So the benefits of depeg would be quite obvious:

- Cope with terms of trade shocks,

- Cope with the fiscal revenue shocks (see chart below and Debt Sustainability Analysis where it is clear that the Debt dynamic could become unsunstainable easily),

- Competitiveness for the nascent / projected manufacturing industries,

- Monetary policy independence from the Fed (see IMF paper on the subject in annex 2 on distortions created by the peg with Fed policy), this is particularly relevant ahead of the Fed’s tightening cycle with possible further dollar appreciation,

- Help the switch between national / foreign workers,

- Foreign capital attractiveness.

What’s needed for an independent monetary policy?

Now there is a sequence usually for a depeg to take place without problems (RBA’s Guy Debel had some good advices for China about that recently). In particular, one must make sure that the central bank will be capable of providing liquidity to the domestic financial sector. Banks have to be ready. I think they are. And for that to go smoothly a bond market (ST, LT) has to be developed. That’s precisely what we have been seeing everywhere in the GCC lately – the so-called Sukuk bonds. And we are starting from a situation of almost no debt as shown below.

Also there are regional considerations. SA is a member of the GCC, so it has to coordinate with its neighbors.

But as recently seen with the Egyptian and Nigerian deval (admittedly they were already in quasi crisis), there is no need to prepare that for years. I guess from this point of view the GCC could do it. To me the level of Oil prices is much more important, to avoid a useless and costly run on reserves to defend the old or new peg system.

Time window considerations:

First, let’s state the basic, when it depegs, it has to avoid being pressurized by outflows. So it HAS to occur in period of strength – that is when Oil revenues are high – ie. when Oil prices are high. If it had depegged in January 2016 (whatever the model / basket that is chosen), it would have had to use its reserves aggressively to counter outflows). Also, ideally the idea is to do it before the Fed accelerates its rate hike cycle (because SAMA will have to hike too), hence creating further pressure on the economy at a really bad time, and particularly so if the dollar rises further. In a sense it is a bit similar to the SNB sudden depeg in January 2015 (2 days after swearing that it would fight for the peg forever), just because the ECB QE was coming.

Second, the timing depends on the financial reforms / privatization program. For instance should they do it before or after the Aramco IPO? Should they do it after the bonds issuance? As a general principle, as just discussed it is important for the domestic financial system to be ready to cope with liquidity provision from the central bank (I think they probably ready). Also the attractiveness of FDI is suppose to increase after the FX regime is clarified and is in line with REER. But I must say, in this specific case, things might differ, I would be happy to talk to an EM IPO expert. I would tend to say after the bond issuance (they already started everywhere in the GCC), but before the Aramco IPO which is too far away.

So overall I would say, I have a large position long USD/SAR, and will turn it bigger, when I feel the odds of timing are improving – typically I would say quite likely before Ramadan (June 6), even more likely after Ramadan (after July 6), and otherwise after the Aramco IPO (planned in about a year).

Conclusion

Of course all of these elements don’t guarantee that they will depeg. (After all, and fortunately for macro traders, the world is full of policy errors). But, for sure, there are many factors suggesting that it would help them in achieving the success of their new growth model. It is a logical measure within their plan, so it should happen within 2 years. I would even argue that I don’t see any reason why they should not depeg, the only real question being the sequence (timing). And as I said, there are many elements suggesting that they may be preparing for such a policy shift, which by definition is NEVER pre-announced, and always denied and fought actively to the last minute – otherwise it’s self defeating. Indeed, any official recognition that the peg could go encourages more outflows which are costly to offset in terms of FX reserves. So be ready for more refutal.

If that happens, it would have important implications – SAR of course, GCC, Oil also potentially, so of course implications for Russia, Norway etc.… I have been asked what proxy to use instead of SAR? Well all GCC are in the same boat from my perspective.

***************************************

Original view in January – as published in FT comments – (forgive typos)

January 28, 2016 4:36 pm

Russia ready to discuss oil output cut with Opec

macrottt Jan 29, 2016

I forecasted this Russian policy shift 2 weeks ago (in communication at least) – when the RUB collapsed (see my blog and twitter account – https://macrottt.wordpress.com/) . Indeed, despite the absence of an imminent russian financial systemic risk, what mattered was the inflationary impact and budget impact (the fund used to fund the budget’s deficit would soon be empty at these levels) which were dramatic . So a Russian reaction was surely going to happen.

Now what really matters is the possibility of an agreement to cut, not the cut itself. Simply because staying short oil then becomes completely crazy given the possibility of a sharp jump to 50$.

So yes, of course Putin as always is negociating with aggressive tactics. He doesn’t want to cut, but he needs a higher price desperately. So we will now have statments and counter statements. Saudis said this, Russia said this, Iran didn’t say this… And a volatile market. But we now all know that they are all in stress and are negociating in secret.

But what matters really is that the fiscal breakeven of Saudi Arabia is about 90$. And it doesnt make sense for them to devalue the SAR as most of their imports and huge foreign workforce (from nepal / india) are paid in USD. And they can’t continue to deplete their FX reserves at this pace. Also the peg has been one of their strongest institution and achieved great results in terms of inflation. It would make much more sense to cut public spending (a thing they can’t do for political reasons). And it is about the same for Russia, the Oil price at 28$ had become a real threat.

Also, even if the production adjustment in Shale is not yet done. It is now clear that the funding of this industry has structurally changed and that many actors will disappear (or merge) in the coming months. Also capex has collapsed. So the strategic goal of the Saudis is achieved. And clearly as I anticpated before the Nov OPEC meeting, they have already said that they were willing to cut – that was a major shift. But nobody cared then. Rightly because Russia didn’t at the time.

So if one wants to stay short in this context, he might be proven right, but given the loss he will make if wrong, that’s definitely not good trading. That’s why the Oil bottoming process has clearly started.

***************

Some good reads / ANNEXES

1/ April 2016 – Economic Diversification in Oil-Exporting Arab Countries – Prepared by Staff of the International Monetary Fund – Annual Meeting of Arab Ministers of Finance

http://www.imf.org/external/np/pp/eng/2016/042916.pdf

2/ IMF Var study on impact of oil & us Monetary policy shocks

http://www.imf.org/external/pubs/ft/scr/2015/cr15286.pdf

3/ Background / Who’s who in the Saud Dynasty

Global View – G7, Yellen & Oil supply

The coming next weeks are likely to be quite volatile as market participants will reconsider several assumptions.

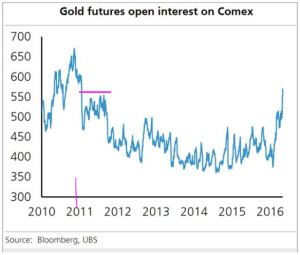

Most important of all, could the Fed hike in June or July? The answer will be given by Yellen this Friday and on June 6. How she stands in the debate of closure of the output gap (employment being at potential or still having room to progress) will be key. In the last few months she was close to Dudley’s views and he was definitely less dovish last week. The repricing move of Fed’s expectations already started since the publication of the minutes last week, but it is accelerating. Most at risk are Gold positions which have reached an exceptional level. I have been short Gold for a few days, and guess that if the current break of 1245/50 is confirmed we could go as low as 1170. One thing is sure, if I was long Gold, I would definitely get out before the Yellen’s speeches.

(Note – charts from soberlook).

Then there is Oil – will the rally reverse? Admittedly it is not on radar screens yet, but since Al-Naimi’s departure (which baffled me and forced me to close some positions at 1AM a Monday morning), I have had the sense that the Oil rally has mostly been driven by temporary issues (Canadian wildfires, Venezuela closures…). Indeed the departure of this historic figure of Saudi Oil policy shows that the Saudi policy has really changed (and not just on economic reforms), and an agreement on a freeze is now very unlikely. Opec meets on June 2 and we will know. But I suspect – as it has been the case for the last 3 years – that due to the “robotisation” of markets, the oil rally has now overshot the fundamentals on the upside, just when net oil longs are at a record high. And importantly, some shale producers could again become profitable and reopen supplies. If that happens that should be seen in the weekly inventories’ inability to drop, today and tomorrow. Of course if Oil drops, it will impact every asset – Equities, commodity FX producers etc… I am planning to short Oil when possible – maybe after another high. And I am so impressed by the Prince Salman reform program that I am convinced that he will have to depeg the Saudi Riyal and consequently I am also long USD/SAR. (In terms of timing though, I guess that even if the end of Ramadan around July 6 could be a good fit, I also think that they imperatively have to do it when Oil is strong).

Apart from these two key drivers, there are several other interesting questions:

Now that the G7/US has clearly disagreed on JPY intervention, will Japan choose the confrontation? And more importantly, how long will it take for real money investors who bought the “Abe in wonderland” story to completely close exposure on Japan? As I have said on many occasions, Abenomics was supposed to be made of three arrows, and the most important was the third one – structural reforms – the only one really capable of dealing with deflationary features. And the first one – monetary policy – was only a temporary “booster” that would mostly help thanks to the FX devaluation. 3 years later, reforms are not really significant, and G7 patience and sympathy has vanished as clearly confirmed this week end by the rare show of tensions with the US. (The systemic nature of the Chinese devaluation threat has also changed the context). I am short USD/JPY – reaching 105 wouldn’t surprise me, and also trying to build a short Nikkei exposure. But BOJ meeting on June 15 might be a better fit for the unraveling…

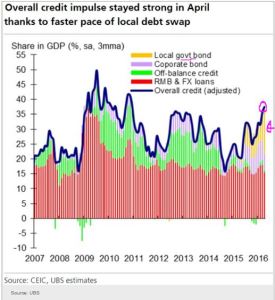

Last important point which might challenge markets, China’s policy support started in Q1, clearly has been reversed somewhat lately due to renewed concerns about a credit bubble. But more importantly there seems to be confusion / disagreement at the top in China. This excellent The economist article presents two different theories for the weird policy “smoke signal” given last week. It might be a sign of upcoming policy volatility. I am long USD/SGD, partly due to deflationary concerns in Singapore, partly on dollar strength, partly on China’s possible weakness.

Changes to the Blog & taking stock on last 2 years of macro trading & development in the macro hedge fund sector

I have gradually stopped publishing on this blog as I was focusing on the finalization of my trading processes. Following this completion and some strong trading performance last year (Romad = 4.9), and in preparation to capital raising discussions, I will now write regularly on market views, drivers and how my risk exposure evolves.

Speak only if you have something original and smart to say…

One thing I hate on the web is the amount of irrelevant things that are published. It is damaging for the authors who sometimes have interesting things to say. So this blog has gradually turned into an arena for my big original strong ideas. For instance in 2 of the last 3 posts I explained:

1/ Why I thought that China would devalue (Nov 2014),

2/ Why I thought that the USD rally would temporarily stop (March 2015),

…These calls were quite originals and successful I must say (I am myself surprised by the accuracy of my timing).

Writing takes an enormous amount of time…

And so instead of using the blog, I have increasingly been using twitter to make quicker shorter comments on my investment cases, significant market moves and more and more comment on my risk exposure. For instance:

3/ In August 2015, after the CNY devaluation that I had been expecting finally took place, I explained in a series of tweets what markets reaction I expected (Nikkei & USD/JPY selloff + EM NJA selloff), and kept a live account of how I traded these great market moves. It was my most profitable month ever! https://twitter.com/DDeddouche/status/630978173929394176

4/ Also, in January 2016, in a series of tweets I explained why an Oil rebound was upcoming.

https://twitter.com/DDeddouche/status/689816162474004480

As an aside… sharing feelings on my macro trading

As I have just talked about this CNY devaluation call, allow me to diverge a bit and give flesh to a few great moments of my trading life. I must say that having the right position when a depeg takes place (I was long USD/CNH on August 9) to me has always been the ultimate intellectual accomplishment in macro trading and provides some great feelings. This is what every (traditional, analytical) macro trader used to dream of, when reading accounts of the Soros positions on GBP in the 1992 ERM crisis. And not just that, trading close to “perfection” the ensuing vertical waves of unwinds in Nikkei and USD/JPY, as panic did spread in August 2015 made me really understood what Paul Tudor once described – “One has to experience both the elation and fear as markets move five and six standard deviations from conventional definitions of value. The only way to learn how to trade during that last, exquisite third of a move is to do it, or, more precisely, live it — a sort of baptism by fire.” Who said that trading has to be boring? Or that macro trading was dead?

[By the way, I am convinced that the Saudis should depeg the Saudi Ryal given their new growth model, and they have to do it while Oil is high. So I am long USD/SAR. But I keep wondering if I have to be just big or huge – as Soros once advised. More on that in a latter post].

… and some thoughts on macro trading strategy and the industry in general

So of course, lately there were lots of articles on the death of macro Hedge Funds. I find that quite ridiculous. But it is true that the industry had to evolve for many different reasons and is being forced to trade differently:

- The first thing to mention is that macro trading – à la Soros or Kovner – is originally about understanding macro-economic developments, understanding policy frameworks and anticipating policy shifts. [As Kovner once said “For example, it is trying to figure out the problems the finance minister of New Zealand faces and how he may try to solve them.”]. And I wonder what percentage of the macro HF sector does really apply that strategy today (or say up until last year). I guess a large part of macro HF had gradually turned into trend followers, Fixed Income funds, or macro algo funds. (Relevant strategies but which are increasingly distant from the business of anticipating macro policies). For instance, some “macro funds” supposedly having a macro strategy had to close when the SNB ended its semi-peg EUR/CHF policy. It was amazing! The internal contradiction of the SNB policy and potential policy failure was something I had written about in 2012, as soon as the SNB started it. It was a risk obvious to anyone with a minimal knowledge of macro policy. You can’t control your monetary policy, have free capital flows and have a peg. It is called the impossible trilemma. It’s macro policy 101! So it seems to me that many macro funds are actually doing something that is not macro trading.

- Importantly and obviously, the economic policy context has changed since 2008. With the experimental nature of policy making since 2008 (QE etc), and much lower growth levels, economies have been very vulnerable to shocks, and consequently policies have been versatile (Fed to taper, then no taper, then taper again, then hike, then no hike, then hike…). So it is a much tougher context than in the old day of 1990 when you could start a long bond position, double, and wait three years to make a fortune. Trends are shorter, reading policy making necessitates a lot of hard work!