Archive

Global View – Thoughts on Capitulation, Contagion and Dollar shortage

Is it already over? Have we reached the capitulation point? That’s really the key question that everyone has in mind in terms of short term outlook, particularly people who were short (as I have advised 🙂 ), so here are a few indicators I am looking at.

The initial panic reaction when fear was most intense lasted about three days, before seeing the first rebound since yesterday evening. That’s a decent move, and I think it could last a bit further after a one day conso. That would be a good point to take profit. There are two things that could easily stop the move, 1/ some reinsuring words from the Fed (we had maybe some preliminary attempts at doing so yesterday with Fisher, Kocherlakota and Dudley all sounding upset by the markets’ reaction), or 2/ a reversal in the bond market. But I don’t see these as very likely in the coming week (the Fed would lose in credibility, while bonds broke some major levels and there is significant US issuance this week).

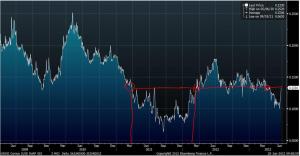

So the key in the short term is going to be how long forced liquidation continue. Some big names have apparently made large losses, and are probably not alone given the verticality of the recent moves. The redemptions at credit ETFs also generated a rare mismatch (sometimes quite large) between ETF prices and the underlying credit bonds… Leverage is a key reason for forced selling, and leverage was high, so that could go on a bit. Interestingly, some indicators of financial stress are worsening, look at the OIS/Libor USD spread below… it rose back to some levels not seen for a while. The banks are rightly more cautious in their short term lending… a counterparty closure can happen so quickly. It is something important to monitor.

In terms of longer term outlook, as I have been saying in my two last posts, what matters is that investors’ assumptions are being adjusted. And in that respect, the Fed’s move was a major inflection point. It is amazing to see how the Fed’s impact on global liquidity is instantly spreading. For instance, as an illustration, I just heard a story of a large European airport issuing a 7yr bond. Last Wednesday it was supposed to be issued at Swap+70bp, then on Friday the talk was +100bp, on Monday it was +125bp, and finally the final price decided today is Swap +170bp. The 7Yr EUR swap has risen by 25bp in one week. So the airport is going to pay +125bp more just because of the Fed, to be clear, that is 3.38% instead of 2.12%… not a marginal change!

Of course, valuations are going to be affected as well. The risk premium concept is based on the 10Yr, so the 100bp rise is affecting all asset classes… Equities, EM… The volatility has also risen, which will affect also valuation and risk exposure. Maybe more important Policy uncertainty has significantly changed. Many investors believed in QE infinity, now even if they’re not seeing rate hikes, at least there is a major uncertainty about what the Fed will do. That’s a big change. That means that macro and fundamentals are going to become more important drivers once things normalize.

More interesting as a sign of global contagion, we are seeing some signs that could suggest that reduced USD liquidity is already being felt. (I will write shortly about the “impossible trinity” to explain how USD liquidity has been leaking into EM Asia during QE because of Asian FX policies). Look at the 2Y cross currency basis swaps in USD vs JPY, or in USD vs KRW. Clearly someone needs dollars in Asia… Maybe it’s due to a domestic factor that I am not aware of, so I stay cautious, but maybe it is due to the Fed’s policy shift… In any case it clearly suggests that there is an increased willingness to pay a large spread to get USD funding. Is it the start of a dollar shortage because of shifting Fed Policy ? (That would hit particularly badly EM Asia). Clearly Temasek (Singapore’s SWF) is very worried about that.

Capitulation is usually signaled by sharp vertical down-moves, with new lows, in high volumes. Last Thursday on the S&P could qualify but that was not the lows, and there were Option expiries which blurred the picture. Star equity performers (JPM and Home Depot for instance) are rebounding nicely which is encouraging. Some for some EM currencies that initially got hit, they have stabilized (USD/TWD or USD/MXN). So overall in terms of market internals the signals are not too conclusive to slightly bullish.

Conclusion: Indicators of contagion (Cross currency basis swaps) and of financial stress (OIS/BOR spreads) are more relevant to me in the current context. USD scarcity, but also reluctance to lend because of fear of a financial accident would be major accelerators of the down move. That’s not what I am expecting so far, but things that bear watching particularly for the summer. Tactically in the short term, I would advise to wait a bit more before taking profits, and reassessing the situation ahead of the key data at the start of July (ISM, NFP). Tapering expectations are going to be highly data dépendent…