Archive

Global View – G7, Yellen & Oil supply

The coming next weeks are likely to be quite volatile as market participants will reconsider several assumptions.

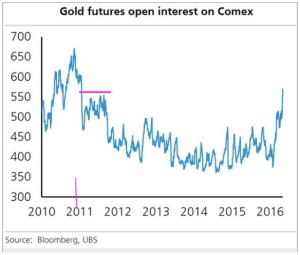

Most important of all, could the Fed hike in June or July? The answer will be given by Yellen this Friday and on June 6. How she stands in the debate of closure of the output gap (employment being at potential or still having room to progress) will be key. In the last few months she was close to Dudley’s views and he was definitely less dovish last week. The repricing move of Fed’s expectations already started since the publication of the minutes last week, but it is accelerating. Most at risk are Gold positions which have reached an exceptional level. I have been short Gold for a few days, and guess that if the current break of 1245/50 is confirmed we could go as low as 1170. One thing is sure, if I was long Gold, I would definitely get out before the Yellen’s speeches.

(Note – charts from soberlook).

Then there is Oil – will the rally reverse? Admittedly it is not on radar screens yet, but since Al-Naimi’s departure (which baffled me and forced me to close some positions at 1AM a Monday morning), I have had the sense that the Oil rally has mostly been driven by temporary issues (Canadian wildfires, Venezuela closures…). Indeed the departure of this historic figure of Saudi Oil policy shows that the Saudi policy has really changed (and not just on economic reforms), and an agreement on a freeze is now very unlikely. Opec meets on June 2 and we will know. But I suspect – as it has been the case for the last 3 years – that due to the “robotisation” of markets, the oil rally has now overshot the fundamentals on the upside, just when net oil longs are at a record high. And importantly, some shale producers could again become profitable and reopen supplies. If that happens that should be seen in the weekly inventories’ inability to drop, today and tomorrow. Of course if Oil drops, it will impact every asset – Equities, commodity FX producers etc… I am planning to short Oil when possible – maybe after another high. And I am so impressed by the Prince Salman reform program that I am convinced that he will have to depeg the Saudi Riyal and consequently I am also long USD/SAR. (In terms of timing though, I guess that even if the end of Ramadan around July 6 could be a good fit, I also think that they imperatively have to do it when Oil is strong).

Apart from these two key drivers, there are several other interesting questions:

Now that the G7/US has clearly disagreed on JPY intervention, will Japan choose the confrontation? And more importantly, how long will it take for real money investors who bought the “Abe in wonderland” story to completely close exposure on Japan? As I have said on many occasions, Abenomics was supposed to be made of three arrows, and the most important was the third one – structural reforms – the only one really capable of dealing with deflationary features. And the first one – monetary policy – was only a temporary “booster” that would mostly help thanks to the FX devaluation. 3 years later, reforms are not really significant, and G7 patience and sympathy has vanished as clearly confirmed this week end by the rare show of tensions with the US. (The systemic nature of the Chinese devaluation threat has also changed the context). I am short USD/JPY – reaching 105 wouldn’t surprise me, and also trying to build a short Nikkei exposure. But BOJ meeting on June 15 might be a better fit for the unraveling…

Last important point which might challenge markets, China’s policy support started in Q1, clearly has been reversed somewhat lately due to renewed concerns about a credit bubble. But more importantly there seems to be confusion / disagreement at the top in China. This excellent The economist article presents two different theories for the weird policy “smoke signal” given last week. It might be a sign of upcoming policy volatility. I am long USD/SGD, partly due to deflationary concerns in Singapore, partly on dollar strength, partly on China’s possible weakness.

RV – On the next G20, German FX policy principles and the EUR/JPY…

The G20, on February 15, could be a turning point for the JPY trade. The market has discarded the French concerns about the EUR/JPY rise. “What can Hollande do anyway?” is the dominant thinking. But F. Hollande could once again benefit from a change in European policy principles…

Germany and the ECB might be against currency intervention in principle, but as we have learnt since 2007, this is no time for big principles in policy making; it is a time for pragmatism. And for Europeans the ultimate goal is to deal with the EZ crisis at the minimal cost. European peripherals are making amazing efforts to improve their competitiveness but they need growth. As we are seeing in Italy, Spain and even France, the depth of these measures have an important political cost. Things have to improve at some stage, otherwise as in Spain and Greece, a fragmentation of the political scene occurs, as fringe parties become more popular.

There are only two sources of external growth: Euro-Zone (EZ) internal growth, or demand from outside the EZ. EZ internal growth is very weak so can’t be a reliable engine. The Germans could help the internal rebalancing process by supporting their own demand, but they won’t because it is an election year and because they would lose in external competitiveness. So demand from outside the EZ, ends up being the most important source of growth for peripheral countries. And if the EUR becomes too strong, the crisis will resume. Moreover the FT explains that, because countries specialize in different type of goods (lower priced, more standardized or higher quality industrial machines…) the “pain thresholds” for the EUR/USD parity are not the same within Europe, 1.24 in France, 1.17 in Italy, and much higher in Germany. So some peripherals are already suffering significantly more from the recent EURO rise. And what really matters is that in the end, if the crisis resumes, it is Germany, or the ECB that are going to pay. So strategically, it is erroneous to expect European policy makers to stick to their historical principles regarding the exchange rate.

Moreover, as discussed previously there are good reasons to be critical of the Japanese policy: 1/ the Japanese policy is setting a dangerous precedent on the international scene (NJA in particular), as the BoK reminded (see my last post); 2/ Their REER is not that high (see my post on JPY); 3/ Most important, they have done nothing in terms of structural reforms efforts, which means that the effectiveness is dubious (see also two excellent articles on deflation and wages, and excess corporate profits).

The Japanese government is well aware of the threat posed by current international criticisms. For instance, contrary to what they have been saying for months they are now saying that their target is not the exchange rate but just inflation. Similarly, Mr Akira Amari, economy minister claimed that “Germany is the country whose exports have benefited most from the euro area’s fixed exchange rate system. [So, Weidmann] is not in a position to criticize.” Frankly was this guy kidding? He apparently never heard about the HARTZ 4 reforms and pauperization of the labor force in Germany? [By the way this comment from a top minister, plus the comments from the Finance Minister Mr Taro Aso, about “enabling [old people] to die off quickly” to deal with the ageing problem (see my JPY post), really reinforce my amazement about the team leading Japan. What’s next? The ballad of Narayama as a government policy?]. The world could eventually accept this kind of policy by solidarity, if Japan was about to be bankrupt, if they had done all the tough reforms, with an unemployment rate of say 15% to 20%. But we are far from that, and actually it is Europe that is in that situation, not Japan – so there are no obvious reasons why the rest of the world would accept it at the expense of its own growth, and particularly at a time of high recessionary risks in Europe.

The most likely is that the US will decide to join the chorus of condemnation at some stage, particularly if NJA gets more vocal. And the Senkaku worsening row is a reminder of how strongly Japan needs the US umbrella. But if the US hesitates, the Europeans have plenty of options to deal with the EURO rise on their own: 1/ first by signaling disapproval from top policy makers – the G20 would be the right place for that; 2/ if that isn’t enough the most likely would be talks of ECB “concerns” about the impact on growth; 3/ then, the ECB could talk about cuts if the EURO remained too strong, 4/ and finally in the worst possible case – there are trade disputes, or even the Sovereign Wealth Fund solution… (Actually France already has one, the Fonds stratégique d’investissement, so far funded by the state, but who knows?… the ECB could transfer some reserves bought when markets become too “volatile”… We leave in a world where amazing things happen…). Moreover, there are many precedents, from the RBA to the BNS, and even the IMF has changed its doctrine on capital controls.

As the great European diplomat and French state man Talleyrand once said: “Use the support of principles, they will eventually end up cracking”. Any sign of a shift in policy makers’ principles about FX (NJA, US or EZ) would offer a great risk/reward opportunity to set long JPY positions against EUR. It can be soon (G20?), or much later (mid 2012? – after the new BOJ governor is nominated). Given the current strength of EUR/JPY dip buyers, it is likely too early. But if / once this catalyst materializes, it would definitely change the JPY dynamics.

Global View update – On today’s FOMC, the 10YR USD and EM FX recent weakness…

Market moves that are inconsistent from a cross-asset perspective are usually meaningful. In that respect, there are two developments that I find interesting. First, the recent general EM FX weakness occurred despite widespread stronger global growth expectations. Second, a continued rise in the 10YR USD yields could threaten the very foundation of the US housing led recovery (and the equity rally), thus doesn’t look like an attractive option for a Fed running a policy reaction function based on asymmetric risks.

EM FX currencies have sold off recently. Several local factors can explain some of the moves: the North Korean missile launch; the South Korean concerns about Samsung and Hyundai; the last elections in Singapore… But why has the TWD, the MXN, the HKD sold off? I hear it was driven by outflows… which is a bit of a tautology. I find only 3 compelling reasons to explain the extent of the move: 1/ It can be due to a limited contagion from the shocks that were centered on the KRW (geopolitical, JPY comments by the BoK, etc…); 2/ It can be due to a general concern about competitiveness from non Japan Asia (by that I mean, not just in S.Korea) following the JPY down-move; 3/ It can be due to the recent rise in the 10YR USD yields which is the valuation benchmark for most assets globally.

What are the implications? If it is linked to point (1), then the move is non-significant and will prove temporary (as the market assumes). If it is linked to point (2) that is something very important, particularly in terms of global rebalancing and the JPY. If NJA starts being affected by JPY weakness, then policy makers are going to adjust, and that is going to be a key problem for the US. Abe is going to the US in February; watch any comments from US (and NJA) officials on Japanese FX policy. Such a policy precedent is unlikely to be welcomed if it bothers NJA. Finally, most importantly, if it is linked to point 3/, then it shows that the recent wave of global optimism is reaching its friction point, as it is starting to affect the valuation of other asset classes. An adjustment in the valuation of some asset classes (EM bonds, MBS?) that have been exceptionally supported by low long term rates would at least trigger a temporary general consolidation.

That brings me to today’s FOMC. Yes, some members signaled in the last minutes that QE3 might end much before the end of 2013. But with the 10YR USD at the highest since April 2012, one doesn’t need to be a FOMC member to realize that at some stage it might start threatening the US housing recovery, which has been a key factor behind the recent US growth recovery, AND has been THE key tool of the Fed’s policy (with mortgage yields). In the context of somewhat mixed data (US conference board yesterday), and the major threat of government shutdown (sequester/debt ceiling), does it make sense for the Fed to give the green light to a further rise in 10YR USD Yields now?

In other words, at some point there is a contradiction between rising 10YR yields and rising equities fuelled by better US growth expectation. I am not sure where that point is, but it surely exists. If, as I suspect, the Fed is somewhat upset by the extent and speed of the 10YR USD rise it can simply point out to the continuous risks posed by the fiscal factor (sequestration / debt ceiling). That would calm down market’s euphoria. After all, the Fed has done a great job at managing market’s expectations over the last 5 years. The market expects a non-event tonight, so there is scope for surprises I think!

In terms of investment implications, the contradiction in the cross asset moves – the recent EM FX weakness and this potentially threatening rise in 10Y USD yields (both for EM and US equities) – tends to confirm the stance I recommended last week (reduce risk, trade tactical). I had considered the possibility of seeing new highs in the very short term (SPX, EUR/USD) so continue to think that the current risk/reward of medium term long risk exposure is not good.

RV – What puzzles me with the JPY trade…

The USD/JPY uptrend has been very popular. I have advised to stay away from it (except through swing trades), as I find the macro case dubious. I remain puzzled by several macro and policy issues, and continue to believe that the risk/reward of being short JPY is not good, particularly given the positioning. There are three things that are particularly bizarre: 1/ If massive BOJ QE is about to unfold – as the JPY prices – we see no signs of it in JGBs or Treasuries; 2/ The biggest source of deflation in Japan is its ageing population and that should be dealt with primarily through structural reforms – we see absolutely no signs of that from the Abe’s government; 3/ Abe’s foreign policy is all but reformist and actually quite worrying; 4/ It looks highly dubious that either the EU or the US will let any large country purchase their govies for pure monetary policy reasons, without reaction.

Will USD/JPY trade next at 100 or at 82? The market is convinced that it will be 100 because this time is different, and these Japanese officials are worth of trust (for once).

I. So it is true that massive QE would trigger JPY weakness.

The graph below shows the ratio of M1 in the US vs Japan, it is clear that increasing the monetary base in Japan would be negative JPY. (Note that the relationship using the monetary base is very strong on the last 30 years, but I couldn’t chart it unfortunately). The correlation between the USD/JPY and the 2YUSD-2YJPY swap rates is also a reflection of this idea. The chart shows that if anything the USD/JPY should have decreased even more during the last wave of Fed QE.

Increasing the monetary base means purchasing assets. It can either be domestic or foreign assets. It is likely that the BOJ is going to increase purchases of corporate bonds, SME loans and ETF, and of course longer term JGBs. In front of this upcoming massive QE, we have oddly enough not seen any rise in the JGBs. That’s the first awkward thing. The JGB market and the FX market are not pricing something consistent. Moreover, in terms of efficacy in the fight against deflation, one should be aware that the strongest / clearest effect of Fed’s QE has been through the effects of lower yields (govies and MBS). So one could ask what will be the effect of BoJ QE as 10Y JGB yields are already at 0.80%? Likely not too big.

Anyway, you might also believe, that the Japanese government is about to buy $555bn of foreign govies through a new fund. Second anomaly, that fact is not reflected in either the Treasury or the European govies market (read Bunds). Moreover, that means that you have the strong assumption that both the US and the EU are going to welcome this kind of monetary policy that is going to affect directly their financial conditions, without reaction! Juncker’s reaction overnight (EUR level dangerously high), but also this paper by PIIE surely suggests that tolerance for currency manipulation and even FX reserves build-up are likely to decrease in a world of flat growth. Moreover, when the EU and the US have gone through hard structural reforms, it is hardly the case of Japan, and with only 10 to 15% of JPY REER overvaluation (unit labor cost based), there is no case for such tolerance from the US or EU authorities.

II. If Abe really wanted to fight deflation; he would at least have attempted some structural reforms.

It is true that the BOJ has not been very proactive in the last decade, in particular it could have started longer term JGB purchases some years ago. And yes, some monetary easing will surely help in Japan. But that doesn’t mean that the BOJ analysis about the structural sources of deflation are wrong. The IMF agrees with that view, ageing is one of the key sources of deflation and anyone serious about ending deflation should at least start a few structural reforms – particularly when they can be financed by a new fiscal spending plan.

As reminded by Bloomberg, 2012 saw a record decrease in Japan’s population. The truth is that for Japan today, ageing is the number one structural problem (see chart above), and the key source of deflation. That is what BOJ’s Sayuri Shirai explains in his great paper. To conceptualize: “Japan entered the demographic dividend period around 1955 and transitioned into the demographic burden period around 1995.” […] He describes this period this way: “As the growth rate of the working-age population lags that of the total population, the total dependency ratio rises. During this period, the decline in the working-age population is likely to directly depress the economic growth rate.” The graph below (from the report) illustrates amazingly well how consumption and growth can be affected by demographic trends. He goes on to link this with deflation: “Japan’s output gap has remained negative almost continuously since the mid-1990s. Generally, the negative output gap is regarded to be caused by cyclical factors or temporary shocks to the economy. However, in the case of Japan, structural factors have also contributed to the long-standing negative output gap. […] The aging population has contributed to the long-term slowing of economic growth. Thus, it is important to conduct structural reforms to strengthen the potential for economic growth.”

The IMF in “JAPAN’S GROWTH CHALLENGE: WHAT NEEDS TO BE DONE AND WHAT CAN BE ACHIEVED?” studied the issue in details and confirms the ideas that ageing is a key source of deflation and that fighting deflation needs above all structural reforms that would allow for higher potential growth. Here are some of the key reforms recommended: “Given the decline in the labor force, increasing participation needs to be an integral part of any growth strategy for Japan.” […] “One obstacle to higher FLP rates is the high drop-out rate of women from the labor force following child birth. ” […] “Women also often provide home-based care for the old-aged, which also prevents them from seeking employment. ” […] “Another disincentive for women to work full-time may arise from Japan’s tax system. Japan’s tax system, like that of many other advanced economies, has implicitly compensated women for not fully participating in the workforce, as tax systems were originally designed to treat families rather than individuals equally.” […] “Reforms of labor contracts are key to creating a more flexible and equal labor market overall. “

The chart above (from the IMF report) illustrates well how bad the situation is in Japan in terms of immigration and Female Participation, and how easily it could improve. If you still doubt it, just look at what the BoK said about immigration and ageing this morning. The BoJ analysis on ageing and deflation, and the need for structural reforms is relevant. Simply raising the inflation target to 2% will probably not solve much if the way to get there in terms of monetary policy tools is not clear, and more importantly if there are no serious structural reforms going on. In a sense, the market misses the point that the BOJ is not faced with the same situation than the Fed. Structural reforms were the priority for anyone serious about fighting deflation. But there are none of these in the latest fiscal package.

III. Abe’s foreign policy… all but reformist

The market is convinced that Abe is a reformist – like Koizumi a few years ago, everything is going to change with him. Deflation will end, and growth will come back. Maybe, but several facts suggest the contrary:

The fiscal measures he has announced last week are classical infrastructure investments, nothing really new here from an LDP perspective. The fact that he is calling for a weaker JPY is just business as usual for a country that has been addicted to export led growth for 50 years. The only real change he has done is ending the BoJ independence, which is not really a reform, but merely going back to pre-2000 policy.

His background also clearly suggests that he is a super conservative. As Wikipedia puts it, in 2006, he was the youngest prime minister of post WWII. He is coming from a powerful LDP political family, his grand-father was a prime-minister, his father also a politician.

More meaningful, his government and it’s foreign policy are really worrying, as the economist brilliantly puts it: “Calling the cabinet conservative misses its revisionist obsessions. It is far from meritocratic, with half the positions going to MPs who inherited Diet seats from their families”.

So is this really the great reformist who is going to end deflation in Japan?

IV . Two final remarks on the trade deficit and the trade rationale…

First, I have noticed lately that the market is so bear JPY that we have a classic case of all scenarios and developments turning bear JPY. For instance some are bear JPY now because the fiscal deficit is projected to reach 245% within a few years, and there is going to be a banking crisis. (In other words JGB and bank stocks should collapse). While simultaneously others are bear JPY because inflation is going to reduce real indebtedness, and bolster nominal growth (and JGB and bank stocks should reach the sky)… Usually when the rationales for a macro trade are so confused, it is not a good sign.

Second, one of the big structural factors that could support JPY weakness – the current account deficit – should prove a temporary phenomenon. Indeed, the collapse in the trade balance (see chart below), was due to the Thailand’s floods, the Japanese earthquake, and the closure of nuclear reactors. But Abe is planning to reopen them (probably after the mid-year election). Moreover global growth is rebounding.

Conclusion

Spending more public money, and finding a convenient scapegoat (the BOJ) and weaken the JPY was the easy part for Abe. The BOJ is likely to obey to some extent next week and move its inflation target. But what will it buy to reach that goal? I would be highly surprise if it dares venturing into foreign bonds (Unsterilized purchases of foreign assets for pure monetary reasons would legitimate JPY weakness, but why would the US and EU accept it?). It will certainly increase purchases of corporate bonds, SME loans and ETF, and of course longer term JGBs – but frankly what would that change when 10YR yields are already at 0.80%?

Expectations are high, positioning is massive. Abe the alleged reformist and the BoJ have to deliver. They might (after all even French socialist just reformed the labor market), but I tend to believe that the odds of disappointment are high.

Global view update – …and short the safe haven assets (CHF, Bunds…)

Last week’s price action was globally as expected. After a consolidation, the market finally broke on the upside. I continue to believe that the bull case has fundamental legitimacy, good follow up and consequently remains the right risk/reward trade.

The dominant driving theme was unequivocally the whereabouts of the fiscal cliff. The price action was interesting as despite signs of public disagreements on Thursday, the markets choose to remain positive. Then it met resistance at 1425 – the big level to break. According to the FT (3 dec), EPFR data showed a 10bn$ inflow in US equity funds the fourth week of November – that is the largest amount in a year (if someone has a chart of that please send it). So for sure, the dominant conviction is that an agreement is going to be found. Admittedly, there are quite positive news: 1/ the two parties are willing to find an agreement (note that according to polls, the Republicans would clearly be seen as responsible in case of failure – they don’t need that right now); 2/ there are splits within the Republican party… so all in all the disagreements are taken like normal negotiating tactics – “political theater” as Geithner would say. That is also what the politico website suggests.

For sure, now that Obama has shown his opening bid, and Republicans showed their own plan, and continue to have internal meetings, progress toward an agreement should come before the Christmas break.

But the most interesting event last week was Gold’s collapse, breaking its correlation with the USD. That revealed the importance of a new driving theme “the end of systemic risk”. Sell your safe haven assets as left tail risks are diminishing.

For sure given the drop in USD, the Gold drop didn’t make sense. From a technical perspective, a correction up to 1650 was always a possibility, so there is no reason to be concerned about the longer term bullish case. But given the proximity of QE4 announcements, and the pro-risk rally, Gold had no reason to fall that much. As always, a move that doesn’t fit your macro framework shows that there is something you are missing. And Gold has always been driven by two factors – 1/ debasement fears, and 2/ systemic risk. Indeed when one goes to Switzerland one understands quickly that many European and Emerging Market investors have been investing in physical Gold, not because of their concerns about the fiat currencies (USD, EUR…), but because of their concerns about the financial system soundness. It is really the “safe haven” function of Gold. And there has been a big change recently – systemic risk has sharply dropped. With Greece’s agreement last week, after the Draghi’s put, the odds of Greece going out of the Eurozone are sharply falling, and that’s good for the banking sector. Peripherals spreads are also tightening fast. More important, the structural improvement (competitivity and current account adjustment) in Europe continues to surprise (see my piece last week + ft article + allianz report => probably the best report I saw last week, it is very encouraging for global growth). And as a consequence, without surprise, all indicators of systemic risk are down – Gold, CHF, JPY, and European financial stocks are up… So this new driving theme – reduced systemic risks – is becoming influential, suggesting that safe haven assets are seeing outflows (not the Bunds yet). One way to play the theme is to use assets that are not too exposed to other factors. So the best way to play it is to try to sell safe haven assets like BUNDS, and CHF, (one can also stay long EU financial stocks). The move already started on CHF thanks to CSFB negative interest rates – but it could go much further, while on the contrary it didn’t start at all on Bunds.

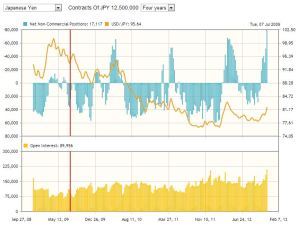

A quick remark on JPY. The “out of safe haven” theme likely helped, but it was of course influenced largely by Japanese politics. So one should avoid shorting the JPY to play that theme. The market is now extremely short (5 year extremes – see the chart – mind the squeeze!!!) By the way, if over the last 4 years you have not learnt to always be against the market’s position, then you were probably not in the markets. To me the risk/reward is definitely to buy it, whatever the fundamental case – and it is not that strong in anycase.

So all in all, the trends I would advise to trade are the following: Long EUR/USD, Long S&P500, Long EUR/CHF, Short Bund. (Stay away from Gold for now as there are now two conflicting themes – QE and reduced systemic risks).